child tax portal still says pending

Child tax portal still says pending. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Wednesday June 8 2022.

. My status on IRS portal says my CTC is pending. There was no reason for it to change in the 1st place. If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify.

I STILL have not gotten a payment for September and it looks like my portal STILL says pending eligibility. Omg I received the first 2 months but not September or October says pending eligibility. Child Tax Credit 2021 This Irs Portal Is The Key To Opting Out And Updating Your Information Cnet.

I got all other stimmies fine. My 2020 return was processed but then went under review. You will not receive advance.

So i dont know if thats considered not processed or not but regardless they should be able to see. The Child Tax Credit Update Portal is no longer available. I dunno whats going.

Im going to scream. Pending for last month and still pending this month. Im listed as pending.

Child tax portal says pending Monday May 23 2022 Edit. Someone please explain to me why my ctc status still says pending eligibility you will not receive payments at this time. Recipients can check the status of the monthly payment at the IRS Child Tax Credit Update Portal.

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet. I am qualified and received the first letter. Why Is My Eligibility Pending For Child Tax.

I have already received my 2020 taxes months ago. I think its because I filed an amended return in 2020 but my tax return status says that Im good to go. If on the IRS website in Eligibility Status of your Child Tax Credit it says Pending your eligibility has not been determined.

Topic E if the IRS has not processed your 2020 tax return as of the payment determination date for a monthly advance Child Tax Credit payment we will determine the amount of that advance Child Tax Credit payment based on information shown on your. If the Child Tax Credit Update Portal returns a pending eligibility status it. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

To be eligible for the full amount a taxpayer must have modified adjusted gross income of 75000 or less for single filers 150000 or less for the married couples filing. This means that instead of receiving. I am a single.

Why is my advanced child tax credit pending eligibility.

September Child Tax Credit Still Not Issued R Stimuluscheck

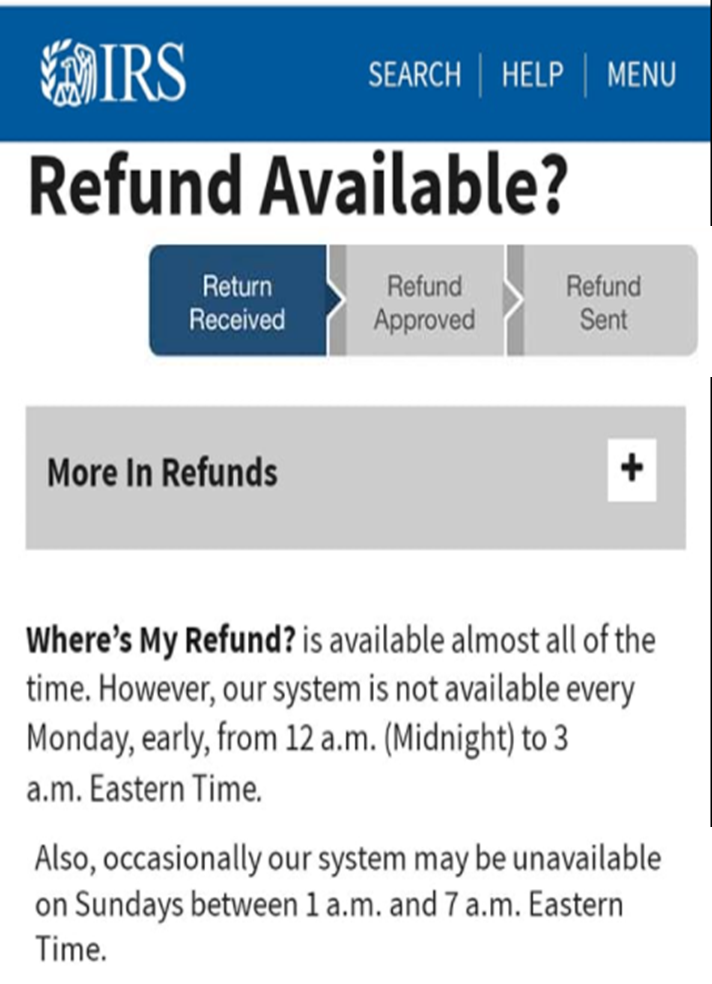

Current Comments Where S My Refund

Child Tax Credits Were Deposited Friday What It Means If Yours Didn T Come The Seattle Times

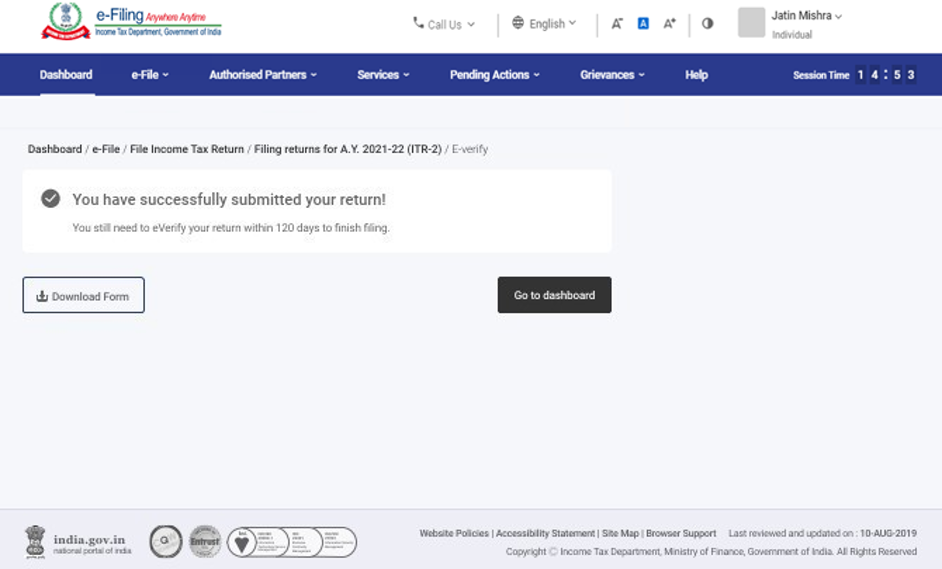

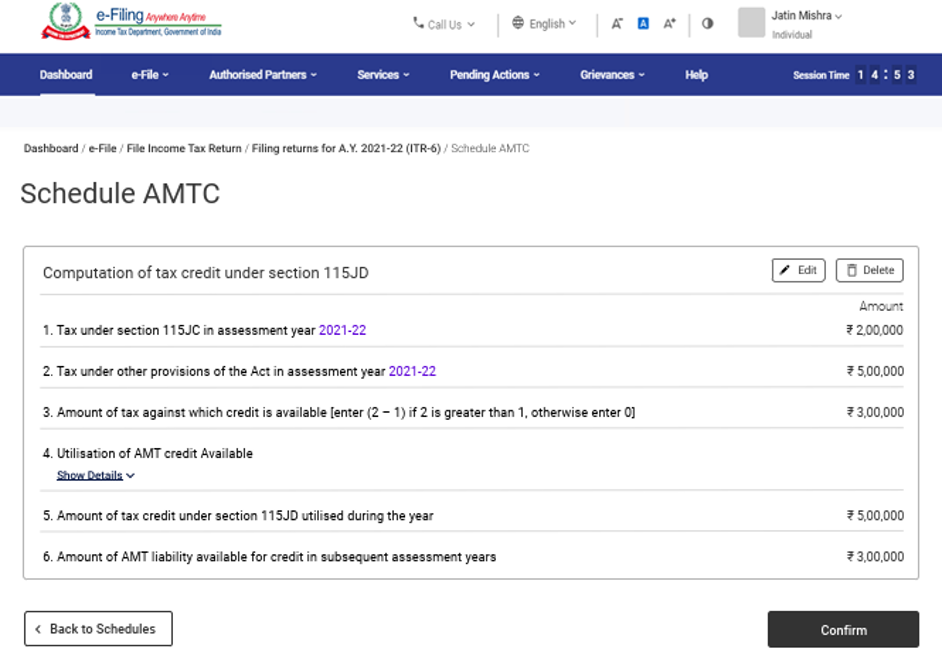

File Itr 2 Online User Manual Income Tax Department

New Income Tax E Filing Website Launched The Hindu

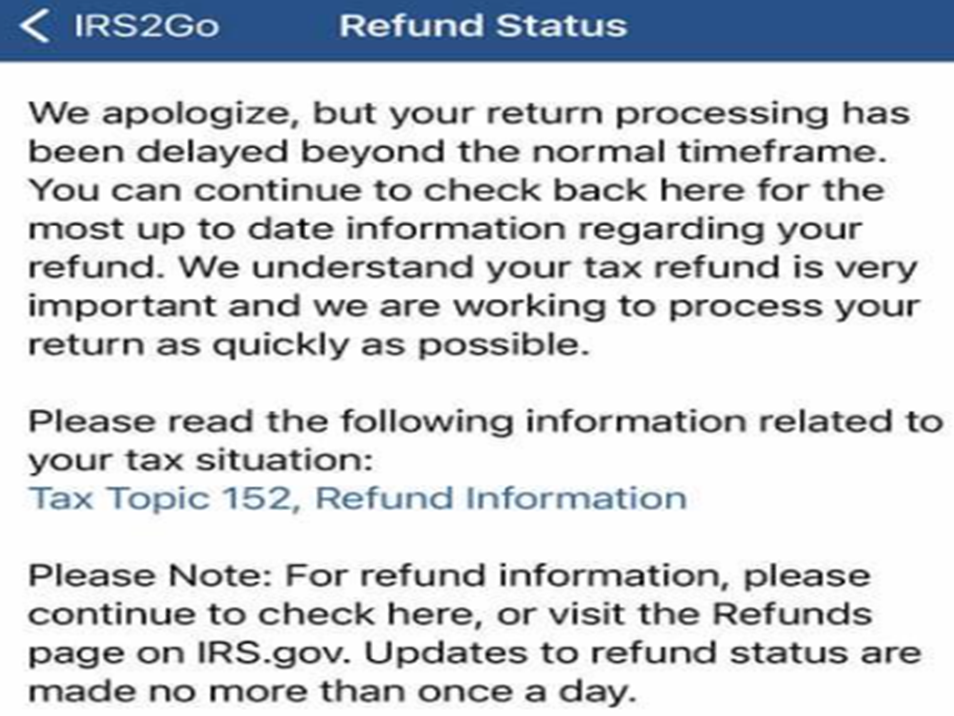

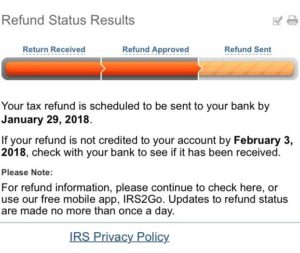

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

File Itr 2 Online User Manual Income Tax Department

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Where S My Refund Posts Facebook

If You Have The Still Being Where S My Refund Facebook

Over 24k Responses Filed Under E Proceedings 40k Itrs Filed Daily On New Portal Cbdt The Hindu

Child Tax Credit Opt Out Or Take The Money Inside Indiana Business